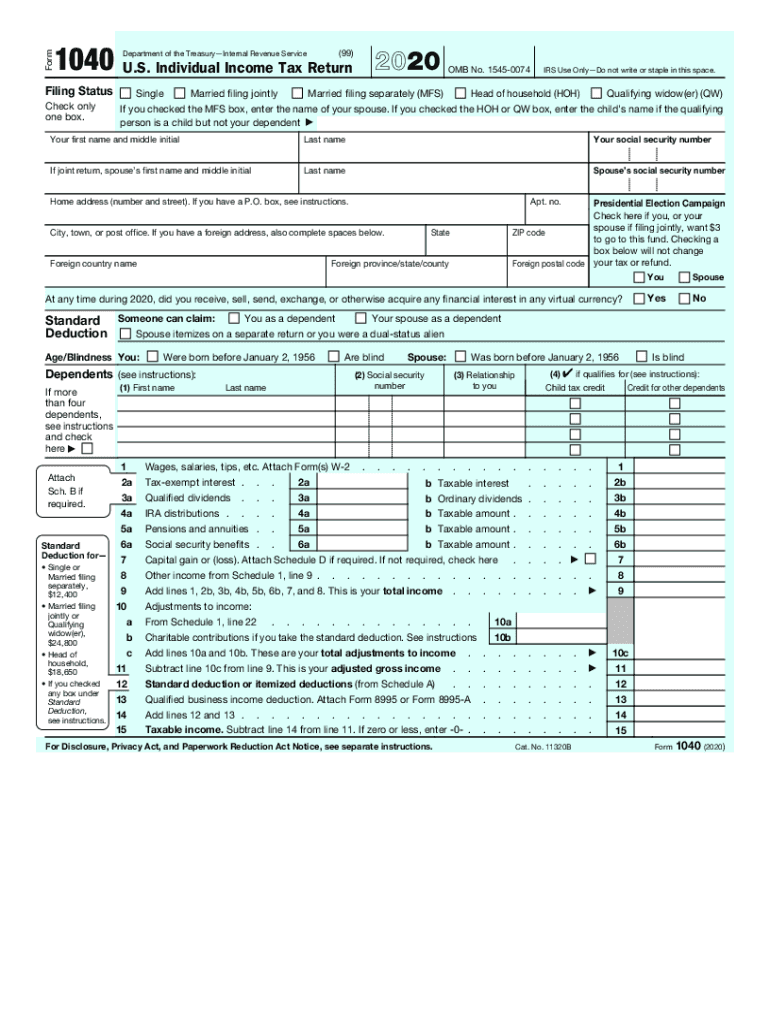

Follow the instructions on page 40 if your income is over $100,000 or any of the special situations on page 40 and 41 are applicable to your tax household. If your taxable income is less than $100,000 and no special situations on pages 40 and 41 apply to your tax household, use the tax table beginning on page 75 of the instructions for Form 1040 to calculate your tax.Be sure to use the number from the column listing your filing status. To determine the amount of your tax, look up your taxable income, from line 43, in the tax tables located at. Once you have completed any lines between 23 and 35 that apply to you, add lines 23 through 35 and enter the result on line 36.ĭetermine the amount of your tax.Follow the directions on the line you qualify for, which should send you to the correct additional form. Many of these adjustments will require additional documentation, in the form of another IRS form.If one, or all, apply to you, it is best to take the adjustment. Go over every line between 23 and 35, deciding along the way if any of them apply to you. There are a wide variety of reasons you can make adjustments to your taxable income.In other words, this section helps you to pay fewer taxes my taking specific deductions off your taxable income.

#1040 form 2020 code

government agency in charge of managing the Federal Tax Code Go to source This section allows you to make "adjustments" to your taxable income, taking off certain amounts of your income that are not taxable. X Trustworthy Source Internal Revenue Service U.S. You can choose “qualifying widow(er) with dependent child” if your spouse died in the two years prior to the current tax year (but not in the current tax year), you have not remarried, you have a dependent child, you pay over half of the cost of maintaining your home, and you could have filed a joint return with your spouse on the year she or he died.Įnter any adjustments to your taxable income on lines 23 – 35, the Adjusted Gross Income section.If that person is a child who is not your dependent for tax purposes, write that child’s name in the line beside the box. If you are not married and supporting other people in your household, choose “head of household”.If you are married, and you and your spouse are each filing individual, separate returns, choose “married filing separately”.If you are married, and you and your spouse are filing your taxes on the same form (even if only one of you has income), choose “married filing jointly”.If you are unmarried, or legally separated, on December 31 of the tax year and are not supporting another person in your household, choose “single”.government agency in charge of managing the Federal Tax Code Go to source This is often, but not always, the status with the highest standard deduction amount. If more than one status could apply to you, choose the one that gives you the lowest tax liability. Advance payments of the premium tax credit were made for you or any dependent enrolled through the Health Insurance Marketplace.Ĭhoose your filing status.You had wages of $108.28 or more from a church or church-controlled organization that is exempt from employer Social Security and Medicare taxes.You had net earnings from self-employment of at least $400.

You received HAS, Archer MSA, or Medicare Advantage MSA distributions.You owe write-in taxes such as additional taxes on health savings accounts.

Even if your income is below these thresholds, you are required to file taxes if any of the following apply: X Trustworthy Source Internal Revenue Service U.S. These vary depending on your filing status and are subject to change annually. Check the instructions in chart A, generally on page 7 of the instructions for Form 1040A for the current income thresholds. Basically, if your income is low enough, you are not required to file income taxes. Determine if you are required to file income taxes.

0 kommentar(er)

0 kommentar(er)